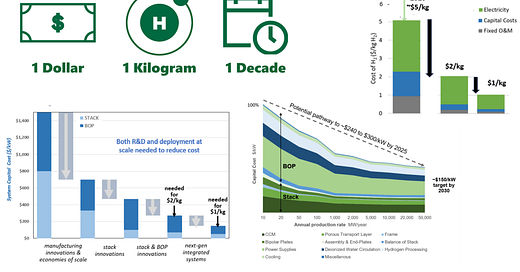

In a recent publication of the US Department of Energy, different targets are established for Renewable Hydrogen. One of the most ambitious one is to produce Green Hydrogen at 1 $/kg at the end of this decade. To do this, two main assumptions are made: OPEX costs (i.e. renewable electricity price) as low as 20 $/MWh and CAPEX costs of electrolysers as low as 150 $/kW. The roadmap points to different developments within electrolysers to achieve this target and shown in Figure 1.

Figure 1. US Department of Energy Roadmap in Clean Hydrogen pointing to the different developments to carry out within electrolyser development to achieve a target of 1 $/kg.

Several questions need to be answered to all move forward in the same direction:

1. Is it necessary to go as low as 1 $/kg to have a clean alternative to fossil fuels?

2. Is 150 $/kW in what we called “Electrolyser” enough?

3. It is possible to achieve those low values in the cost of electrolysers?

Let’s start one by one.

Is it necessary to go as low as 1 $/kg to have a clean alternative to fossil fuels?

Green Hydrogen is called to replace current uses of fossil hydrogen (mainly fertilizers and refining of oil). In many scenarios and for many institutions as IEA and IRENA is also thought to be the solution where electrification is rather difficult (steel, long haul trucks, shipping, aviation). Lots of debates and articles are written around how much renewable and green hydrogen will be needed, which also brings frustrations around the complex task of producing renewable hydrogen, and therefore, displacing the use of fossil fuels.

However, to answer this question we need to see how expensive is the current fossil fuel alternative which green hydrogen is coming to replace. This does not have a straight answer as fossil fuel prices vary a lot depending on regions in the world. While in US and China, the cost of fossil hydrogen lies in the 1.5 $/kg |1.3 €/kg, in Europe would be much closer to 2.5 $/kg |2.3 €/kg due to the higher geopolitical tensions with Russia and therefore higher natural gas prices, as well as the higher carbon taxes. Therefore, it seems that a target closer to 2 $/kg by 2030 should be much more in line with a world having more renewable hydrogen available to replace fossil fuels in those applications difficult to electrify rather that as a general “silver bullet”.

Figure 2. Author own LCOH calculations in function of electricity price for two different scenarios of CAPEX and OPEX. CAPEX includes all the equipment necessary to have in a Hydrogen Plant. Capacity factor of 90 % and discount rates of 5 % are considered.

Is 150 $/kW in what we called “Electrolyser” enough to achieve?

We normally have the tendency to believe that with an electrolyser, our hydrogen production will be solved, but this quite far from reality. It is quite important to distinguish the electrolyser equipment from the rest in a hydrogen plant. Figure 3 shows the different components that a theoretical hydrogen plant may have: in addition to one of more electrolyser systems, the plant should include further components that are normally included in the so-called balance of plant, with lots of confusion of what it is included and what it is not in this term.

Figure 3. Representation of all the components included in a H2 plant: from electrolyser equipment to the balance of plant and including the civil works.

In addition to the balance of plant, non-neglectable items related with civil works should also be considered. This all makes that the final CAPEX of a Hydrogen Plant becomes between two and three times more than the electrolyser equipment CAPEX.

Observing the results obtained in Figure 2 and these considerations, CAPEX prices of the whole hydrogen plant are between 375 €/kW and 755 €/kW what would translate to electrolysis range equipment between 125 €/kW and 375 €/kW, very close in the low end to the 150 $/kW indicated in the US Roadmap.

Is it then possible to achieve those low values in the cost of electrolysers?

The more important parameter that makes this target to be achievable or not is the raw materials. Figure 4 shows raw material cost for the three more common electrolysis technologies: Alkaline, PEM and SOEC. Only in the case of PEM, raw material costs seem to be an issue, although recent R&D developments show us that significant reductions of Ir loading as well as the replacement of many Ti components by stainless steel can be realized, leading to much favourable raw materials costs also in this technology. As the US Roadmap points out the increase development and R&D investments in advance materials and manufacturing methods will help to achieve these goals.

Therefore, although no free of many challenges ahead, it seems that green hydrogen production can be realized at good cost at the end of this decade (2 $/kg) with a good combination of a better understanding of hydrogen plant requirements, cost-effective electrolyser manufacturing developments and low prices of renewable energy.

This analysis conveniently ignores the power cost challenge, just as DoE document did.

Access to power transmission networks and assets results in costs which are real and unavoidable and represent a ~USD 10-15/MWh stack component of the actual cost of power feeding into any load met by the system, including hypothetical hydrogen projects.

This means that when you just assume "low prices of renewable" you must include that cost element in your analysis.

On top of that, you have the challenge of intermittency of supply very inflexible and costly downstream elements.

Even if things could go as cheap and as quickly as you unrealistically assume, you still need to find a cheap enough way to firm up power to an unavoidable level of uninterruptible demand across electrolysis, balance of plant and eventual liquefaction or compression of hydrogen, or synthesis of it into ammonia.

If and when you do your maths, down to the hourly and day to day picture of what you are talking about, you will appreciate that USD2/kgH2 electrolytic hydrogen is not likely to happen in the next 10-15 years, if ever at all.