A resilient and good supply value chain for electrolyser manufacturing is essential to achieve our goals.

Europe has set good grounds to compete better in the race to provide with this essential piece of clean technology to the ground. However, it is still lots of work to do which can be seen as plenty of opportunities for Europe to take.

The very recent report published by the IEA: Advancing Clean Technology Manufacturing: An Energy Technology Perspectives compares different clean technologies and includes electrolysers.

These are the main takeaways from the report focusing on electrolysis:

Current Status and Trends

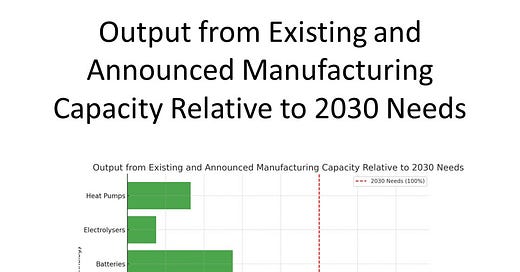

Manufacturing Capacity: Existing manufacturing capacity for electrolysers could already deliver approximately 15% of the deployment needs by 2030, as outlined in the IEA's Net Zero Emissions by 2050 Scenario (NZE Scenario). Even with much more conservative volume goals (i.e. 200 Mt by 2050), this capacity will need to increase considerably.

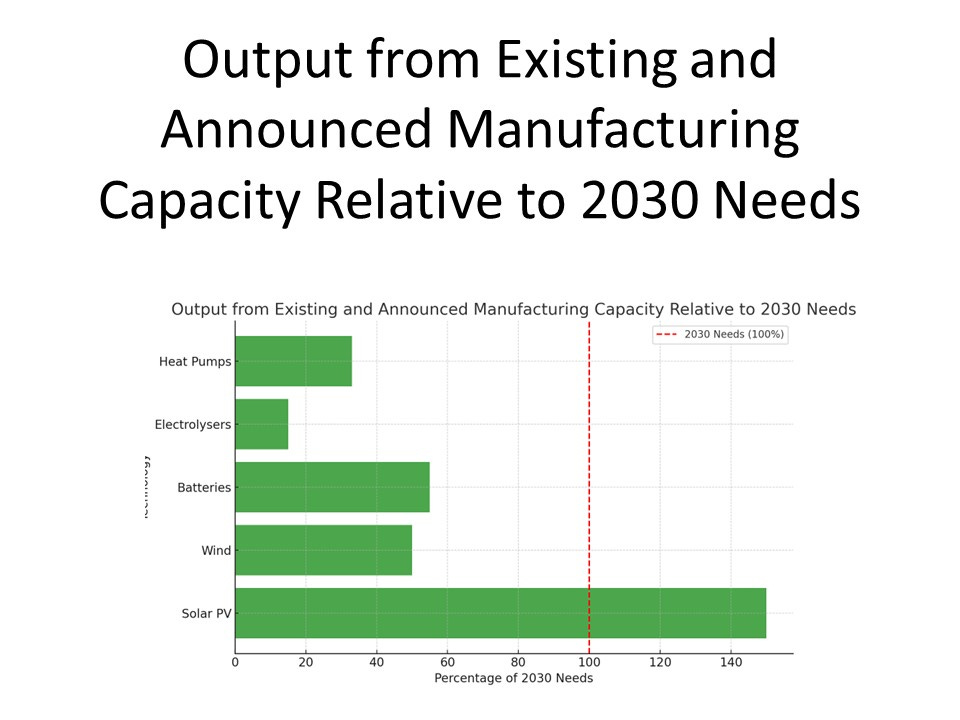

Investment Growth: Investment in electrolyser manufacturing grew faster in 2023, although the gains were not as dramatic as other technologies such as solar PV and batteries.

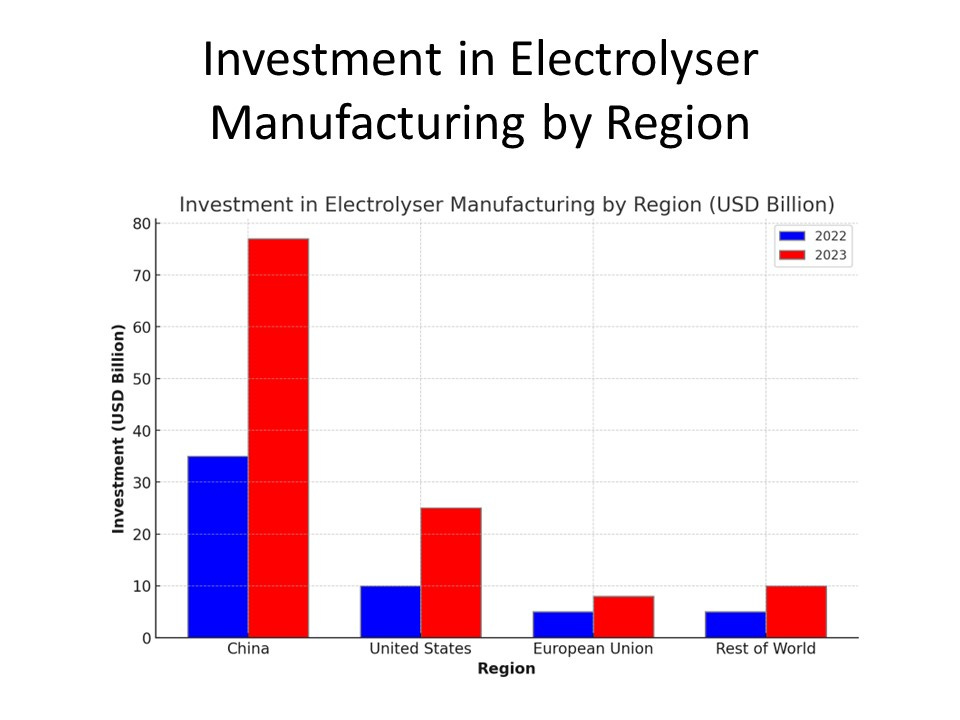

Geographic Distribution: The geographic concentration of electrolyser manufacturing is high, primarily in China, the United States, and the European Union. There is minimal investment in electrolyser manufacturing outside these major hubs.

Key Insights

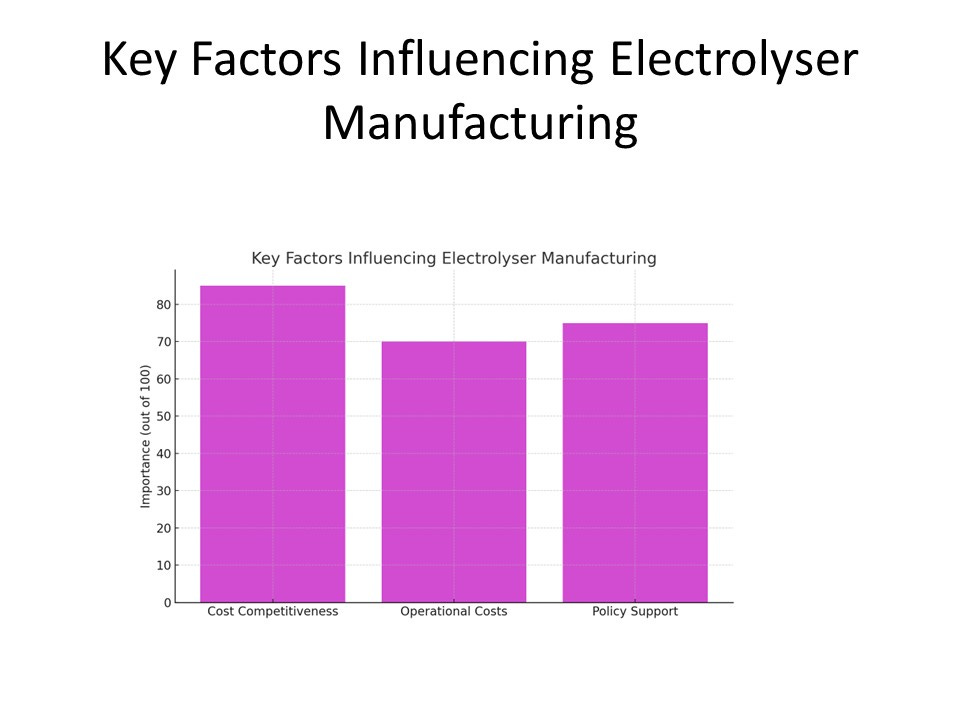

Cost Competitiveness: China remains the lowest-cost producer for electrolysers before accounting for explicit supportive policy measures. This provides China a competitive edge in the manufacturing of electrolysers.

Operational Costs: Operational costs, including energy, material, component, and labor costs, contribute significantly to the overall production cost. Reducing these costs is essential for improving the competitiveness of electrolyser manufacturing.

Investment Requirements: Facilities in the United States and Europe are typically more expensive to set up than those in China. Capital expenditure for manufacturing plants in these regions is 70% to 130% higher per unit of output capacity compared to China. High efficient technologies as SOECs will help to reduce this gap.

Challenges and Opportunities

Supply Chain Integration: Enhancing synergies from supply chain integration is crucial for reducing costs and improving the efficiency of electrolyser manufacturing.

Innovation: Continuous innovation in manufacturing processes and technology is necessary to overcome high-cost factors and maintain manufacturing competitiveness. Policies that support R&D, rapid prototyping, and scale-up of production are important.

Policy Support: Strong policy support, including R&D grants, project finance, and training programs for skilled workers, can help attract investments and foster growth in electrolyser manufacturing.

Future Outlook

Capacity Expansion: If all announced expansions for electrolyser manufacturing are realized, the output could meet the deployment needs for 2030. However, significant investments and policy support will be required to achieve this.

Global Distribution: The future of electrolyser manufacturing will likely see continued dominance by China, with the United States and the European Union also playing significant roles. Efforts to diversify manufacturing capacity to other regions will be necessary to ensure global supply chain resilience. In addition, the development of both PEM and SOEC will even this dominance.

Let’s harness these insights to drive forward the electrolyser manufacturing sector and support a sustainable future.